Pi & the economy

Photo: Gabby K. / Pexels.com

At the market in your local town, you buy a piece of cheese. Similarly, there is also a financial market where you can buy pieces of companies. This market is called the stock market and those pieces of companies are called shares. The people who buy and sell shares are called investors. Many people are not concerned with this, yet our entire economy depends on the stock markets. You can see this especially when things go wrong, for example in 2008 when the stock markets collapsed worldwide. Companies went bankrupt, many people lost their jobs and some of them even their homes.

Photo: Lorenzo / Pexels.com

As you can see here, the price of a stock fluctuates heavily. The price of a share in company X depends on how well or how bad company X is performing. Put differently: depends on what investors think of company X. Investors will sell their shares if they think the company is not doing well. If the shares are sold by large numbers, the price of the shares will take a dive.

A time series of the price of a stock. Source: EdX

Above you see a time series of a stock: the change in price over time. Of course, it would be fun if you could predict this line! You can then buy shares of a company that will be worth ten times as much in two years. Of course, everyone would be a millionaire if this were not a fable. The prices of shares cannot be predicted. Because of this unpredictability, investing is often seen as risky.

Photo: Brooke Lark / Unsplash.com

However, by using math you can modorate these risks! In fact, there are options on stocks, which act as a kind of insurance. For example, an option on a stock gives you the right to sell the stock in the future for a certain price. Suppose you own a Gamestop share worth 125 euros. Suppose there is an investor who wants to sell you an option on this stock. With this option you have the right to sell him your Gamestop stock in one month for 140 euros. If the share is worth 120 euros in one month, you can still sell it for 140 euros! If the stock is worth 150 Euros, you either keep the stock for yourself or you sell it on the stock market for 150 Euros.

Photo: Clay Banks / Unsplash.com

You probably like the sound of that: no matter what happens to the price, you always make a profit! But of course you don't get an option like that for free. The option has a price and that price has been cleverly calculated by the selling investor. In the past, determining such a price was difficult and was done on the basis of conjecture. The "Black-Scholes Formula" changed this. This formula enabled investors to use mathematics to provide a theoretical estimate for the price of an option. The formula led to a major breakthrough in the financial world. It was now even possible to avoid risk by putting together the right combination of options.

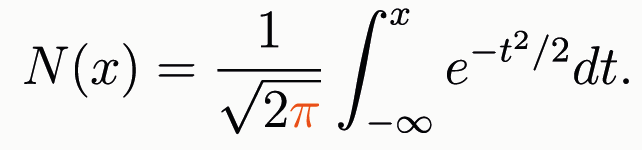

A part of the overall Black-Scholes formula: the standard normal cumulative distribution function. Obviously, you don't need to understand this formula for this story. In studies such as financial mathematics and econometrics, this formula is studied extensively.

The constant π appears in this important formula as well! The formula N(x) originates from the normal distribution: a probability distribution. This formula is used in the Black-Scholes formula to determine the probability of a stock price. In this way, uncertainty in the stock market is taken into account. The normal distribution recurs in many science disciplines. Hence π can be found in many applications!